Starting a company can be an exhilarating journey, but it comes with its own set of challenges and complexities. One of the first hurdles many entrepreneurs face is understanding the language of startups. From MVPs to venture capital, knowing these essential startup terms can significantly impact your ability to navigate the startup ecosystem effectively.

In this guide, we will walk through essential startup terminology that every founder, investor, or team member should understand. Whether you are launching your first business or scaling your existing one, mastering these key concepts will help you communicate better, make informed decisions, and attract funding more effectively.

Table of Contents

- MVP (Minimum Viable Product)

- Venture Capital

- Angel Investor

- Profitability

- Burn Rate

- Seed Round

- Product-Market Fit

- Bootstrapping

- Convertible Note

- SAFE (Simple Agreement for Future Equity)

- Equity

- Total Addressable Market (TAM)

- Valuation

- IPO (Initial Public Offering)

- ARR (Annual Recurring Revenue)

MVP (Minimum Viable Product)

The concept of a Minimum Viable Product (MVP) is foundational in the world of startups. An MVP is essentially the most basic version of a product that allows a team to collect the maximum amount of validated learning about customers with the least effort.

It’s crucial to remember that while simplicity is key, the product must still be useful enough to serve a purpose for the customer. This viability ensures that the MVP can attract early adopters and provide valuable feedback for future development.

For example, if you’re building a mobile app, your MVP might only include core functionality, just enough for users to engage with the product and give feedback. The keyword here is “viable,” not just “minimal.”

Venture Capital

Venture Capital (VC) refers to funds invested in startups and small businesses with strong growth potential. Venture capitalists typically invest in exchange for equity in the company, hoping to achieve substantial returns if the business succeeds.

The VC industry is characterized by high risk and high reward; while many investments may not succeed, those that do can yield significant profits. Historically, the term “venture capital” was inspired by the whaling industry, where investors would fund multiple expeditions, knowing that only one successful whale hunt could cover all losses and generate profit.

Today, VCs operate similarly, investing in multiple startups with the hope that a few will become highly successful and profitable.

Angel Investor

An angel investor is an individual who provides capital for a startup, usually in exchange for convertible debt or ownership equity. Unlike traditional venture capitalists, angel investors often use their own money and are typically involved at the earliest stages of a company’s lifecycle.

They may write smaller checks, ranging from $20,000 to $50,000, and are often motivated by personal interest rather than professional investment strategies. Angel investors tend to be retired entrepreneurs, wealthy individuals, or part-time investors who support promising ideas they believe in.

Profitability

Profitability is a measure of a company’s ability to generate profit relative to its revenue, assets, or equity. For startups, profitability isn’t just about making more money than you spend; it’s also about understanding how your margins change as your business scales.

Initially, a startup might operate at a loss but aim to increase profit margins as it grows and achieves economies of scale. For instance, Google didn’t generate revenue in its early years but later became extremely profitable once it launched its advertising platform.

Understanding profitability helps founders forecast financial health, optimize spending, and plan for sustainable growth.

Burn Rate

Burn rate is a critical metric for startups, indicating how quickly a company spends its cash reserves before achieving positive cash flow. Understanding your burn rate helps founders manage finances wisely, ensuring they don’t run out of funds prematurely.

For example, if a startup starts the month with $1 million and ends with $900,000, the monthly burn rate is $100,000. Monitoring burn rate closely allows entrepreneurs to adjust spending habits and prioritize financial sustainability.

Founders must pay close attention to both revenue and expenses to ensure that the company remains solvent long enough to reach key milestones like product-market fit or Series A funding.

Seed Round

A seed round is the initial funding stage where a startup raises capital to transform ideas into tangible products or services. While there’s no strict definition, a seed round typically involves raising smaller amounts of money compared to later funding rounds like Series A or B.

Seed funding often comes from angel investors or incubators and serves as the foundation for future fundraising efforts. It’s usually the first formal investment a company receives and can vary widely in size and structure.

Unlike larger funding rounds, seed rounds often lack a lead investor and may consist of multiple small contributions from various backers.

Product-Market Fit

Achieving product-market fit means finding a balance between what a product offers and what the market demands. This milestone indicates that a startup has developed a product that resonates with its target audience, leading to increased demand and customer satisfaction.

At Y Combinator, we emphasize that pre-product-market fit companies should focus entirely on validating their product assumptions and iterating based on customer feedback. Once product-market fit is achieved, the focus shifts to scaling and growth.

Founders should recognize that the strategies and priorities differ significantly depending on whether they are in the pre-PMF or post-PMF phase.

Bootstrapping

Bootstrapping refers to starting and growing a business using personal savings and revenue generated by the business itself, without external funding. This approach allows founders greater control over their ventures and reduces dependency on external investors.

Bootstrapping is particularly suitable for businesses that don’t require large upfront investments and can grow steadily through organic means. Many successful companies have been bootstrapped, proving that external capital is not always necessary for success.

However, bootstrapping requires careful financial management and a focus on sustainable growth. Many well-known companies like Basecamp started as bootstrapped ventures.

Convertible Note

A convertible note is a form of short-term debt that converts into equity, typically during a future financing round. Investors lend money to a startup with the expectation that the loan will convert into shares at a discount or valuation cap when the company raises additional funds.

Convertible notes offer flexibility for both startups and investors, allowing them to defer pricing negotiations until a later date. However, they often come with interest rates and maturity dates, so founders must read the fine print carefully.

SAFE (Simple Agreement for Future Equity)

A Simple Agreement for Future Equity (SAFE) is a financial instrument designed to facilitate early-stage investments in startups. Created by Y Combinator, SAFEs allow investors to contribute capital without immediately determining the company’s valuation.

Instead, investors receive the right to purchase equity at a future date, typically during a priced round, under predetermined conditions. SAFEs are simpler and more founder-friendly than convertible notes, with fewer terms and fewer investor rights.

They are ideal for early-stage fundraising when setting a valuation is difficult or premature.

Equity

Equity represents ownership in a company and is expressed as a percentage of the total shares outstanding. Founders, employees, and investors all hold equity, which entitles them to a portion of the company’s profits and decision-making power.

Employees may receive stock options instead of direct equity, giving them the right to purchase shares at a predetermined price in the future. Understanding the nuances of equity distribution is vital for maintaining alignment among stakeholders and ensuring fair compensation practices.

Total Addressable Market (TAM)

Total Addressable Market (TAM) is a metric used to estimate the maximum revenue opportunity available for a product or service. TAM calculations involve analyzing the potential customer base and estimating the number of units that could be sold if every possible customer purchased the product.

While actual market penetration rarely reaches 100%, TAM provides a useful benchmark for assessing market size and growth potential. For example, Tesla initially had a small TAM for electric cars, but as the market grew, so did the TAM.

Valuation

Valuation refers to the process of determining the economic value of a company. In the context of startups, valuation is often based on projected future earnings, market comparables, and other qualitative factors.

Unlike publicly traded stocks, private company valuations lack liquidity and transparency, making them subjective estimates rather than definitive values. Startups may raise funds at certain valuations, but those figures don’t necessarily reflect the company’s actual worth in the open market.

IPO (Initial Public Offering)

An Initial Public Offering (IPO) marks the transition of a privately held company to a publicly traded entity. During an IPO, a company issues shares to the public markets, enabling broader ownership and access to capital.

IPOs represent significant milestones for startups, signaling financial maturity and operational success. They also allow employees, founders, and early investors to realize financial gains from their hard work.

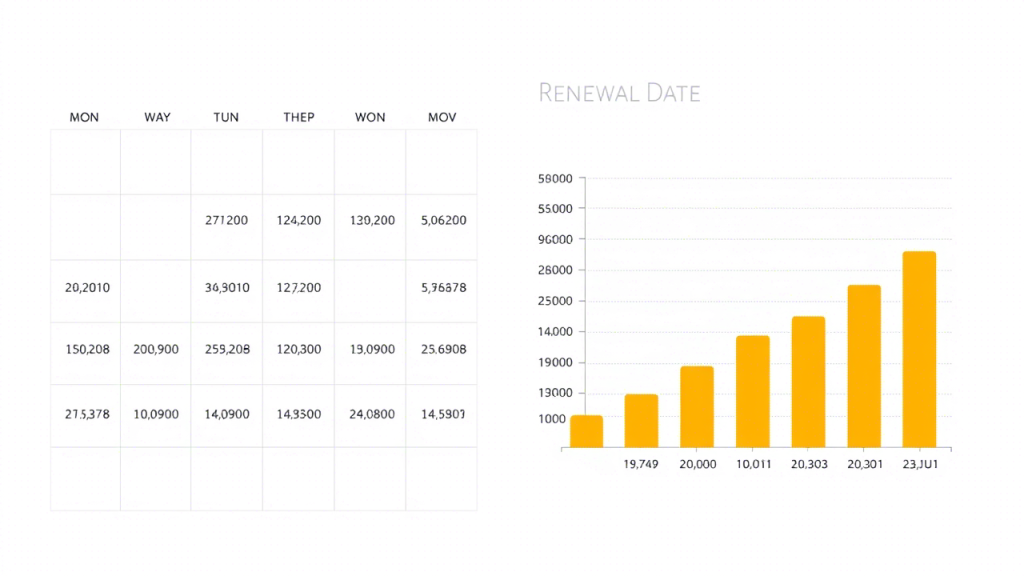

ARR (Annual Recurring Revenue)

Annual Recurring Revenue (ARR) is a key performance indicator for subscription-based businesses, reflecting predictable revenue streams derived from annual contracts.

ARR helps companies forecast future earnings and assess customer retention rates. Ensuring recurring revenue aligns with contractual obligations is essential for accurate financial reporting and strategic planning.

For example, if a SaaS company has 10 clients each paying $100,000 annually, its ARR is $1,000,000. Tracking ARR is crucial for measuring growth and scalability in subscription models.

By familiarizing yourself with these fundamental concepts, you’ll be better equipped to navigate the dynamic landscape of entrepreneurship. Whether you’re seeking funding, building a product, or scaling your business, understanding these terms will empower you to make informed decisions and drive sustainable growth.